The Central Bank of Nigeria (CBN) in collaboration with the Nigerian Inter-Bank Settlement Systems (NIBSS) is set to launch the AfriGo National Domestic Card Scheme. The scheme, which was first introduced at a press conference hosted by the Bankers’ Committee in October 2022, involves the central bank in the market’s triopoly of card payment schemes.

The Central Bank Governor Godwin Emefiele speaks during the virtual launch of the new Nigerian card claims that this initiative will promote financial inclusion and consolidate card financial data in Nigeria while also serving as a source of national pride for those who embrace it. The CBN governor stated, “The national domestic card avails us the sovereignty of our data. Secondly, it comes at lower costs.”

Nigeria remains a sizable market for players in the card payments market, which is largely dominated by global players like Mastercard and Visa, with Verve by Interswitch sliding behind. The annual value of card transactions in the Nigeria cards and payments market will be capped at $18.2 billion in 2021.

These multinational companies offer centralized payment networks, which they connect to debit and credit cards to permit and simplify cash withdrawals using the card. Customers may then receive the cards from banks, financial institutions, or even retail stores.

The CBN, in collaboration with the Nigeria Inter-Bank Settlement System (NIBSS), is positioning itself to disrupt and perhaps control a rapidly expanding market by ending the triopoly and launching a national card payment system. The CBN attributes the success of its most recent push into fintech to decreased operating expenses and optimized foreign exchange utilization.

According to the apex bank governor, “has foreign exchange challenges continue to persist globally, it is important for me to say that we have come up with this card to ensure that all online card transactions will now, effective immediately, begin to go on the Nigerian national domestic system.”

He added that the “NIBSS and CBN will work together to make sure foreign exchange is charged for only international transactions made on Visa and Mastercards as we have it now. This is so because many of the cards we use currently charge in foreign currency. However, with the launch of the national domestic card, all domestic transactions are to be carried out on the national domestic card scheme.”

This “homegrown” initiative is notable for being the first of its kind in Africa. Still, it follows a similar path to several other leading countries including China, India, Brazil, and Turkey. Due to its effectiveness, affordability, and support from the government, Rupay, a card payment system, dominates the market in India. Over 600 million Rupay cards have been distributed as of this publication.

The NIBSS’s managing director and CEO, Mr Premier Oiwoh, stated that the program was created to solve some of the industry’s unique problems and offer specialised, cutting-edge services.

Nigerians would be able to use debit cards and similar products for less money if this initiative become a success just like the Rupay was. However, the reliability and interoperability issues won’t be fully resolved when the cards are put into use.

Speaking about how this decision might impede competition from international players, Emefiele noted that the “Nigerian market is vast and that the current participants have changed the ecosystem significantly over the past 12 years. However, there is still a lot of ground to overcome because millions of Nigerians still lack cards to complete transactions.” The apex governor added that “I am convinced that the national domestic card scheme will make this a reality in the coming months. We can no longer neglect the vast majority of Nigerians.”

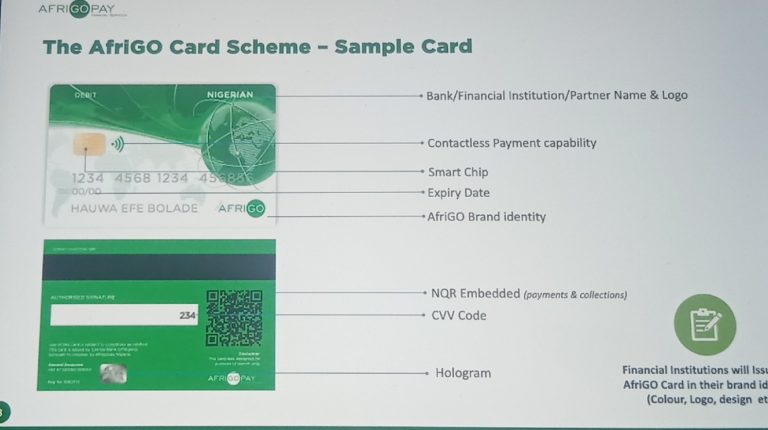

The NIBSS-affiliated company AfriGOpay Financial Services Limited (AFSL) will be n charge of implementing and supervising the adoption of the national domestic card program. The program is aimed at providing more options for domestic consumers, driving the cashless economy policies of Africa’s biggest economy and saving the nation’s foreign transaction fees. Recall in 2021 the central bank of Nigeria launched a not-so-similar initiative with the e-Naira

Discover more from TechBooky

Subscribe to get the latest posts sent to your email.