Nvidia’s revenue soared 262% in the first quarter, surpassing even the highest forecasts, owing to record sales of artificial intelligence processors. The company’s CEO stated that blockbuster growth will continue this year with the introduction of a new chip line.

Jensen Huang informed investors that the business would capitalize from the rapidly growing need for the processing power underpinning generative AI and would see “a lot” of revenue from its new Blackwell chips this year. Huang stated that Blackwell would help the company enter a new phase of growth and that Nvidia would keep releasing newer, more potent chips at the same rate. “There’s another chip after Blackwell, and we are on a one-year rhythm,” he stated.

Over the past year, Nvidia’s AI data centre graphics processing units have seen an explosive increase in demand as the largest tech companies race to build the computer infrastructure required to produce cutting-edge new AI products on a large scale. Amazon, Microsoft, Google, and Meta have all stated that they plan to continue spending heavily in 2024.

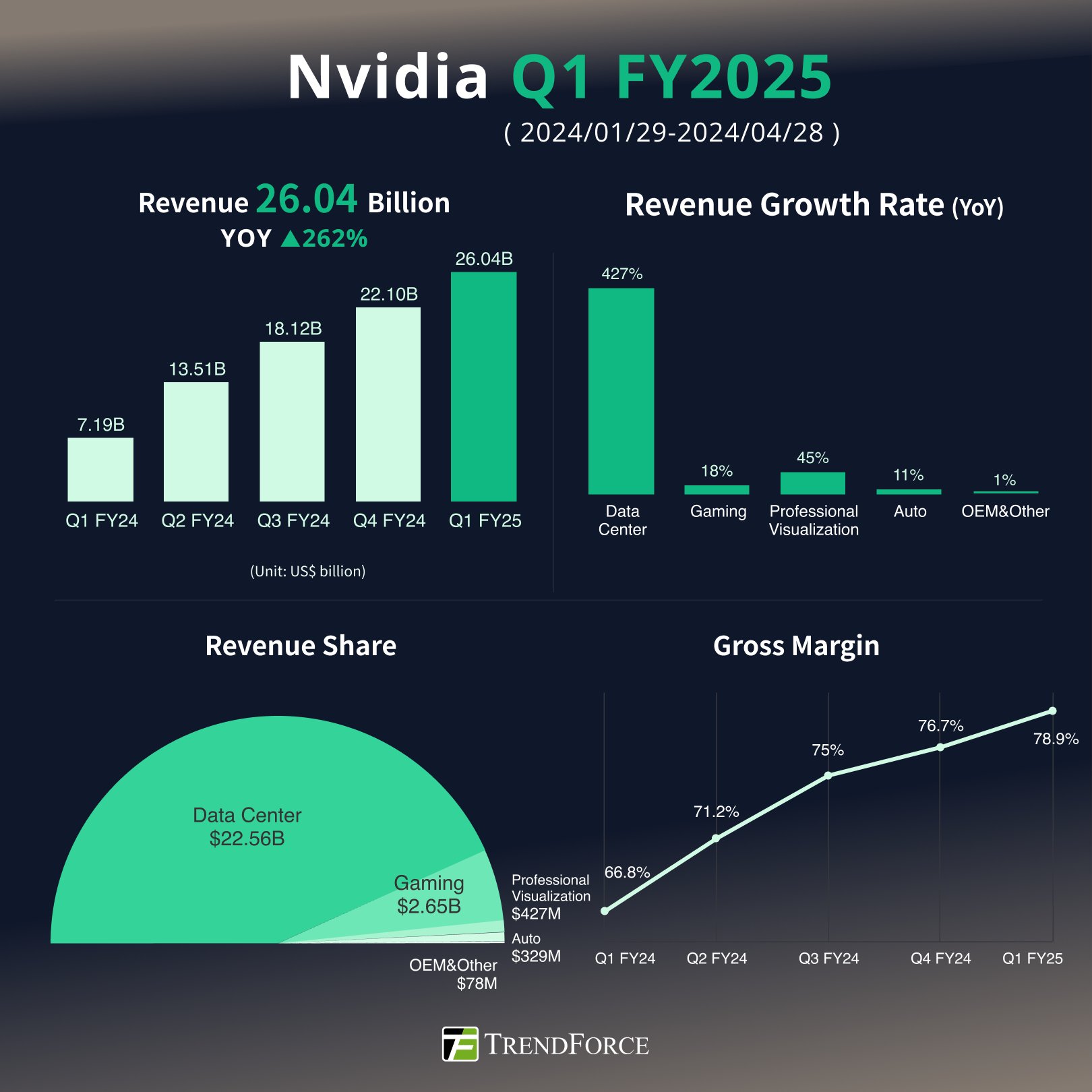

Comparing revenue for the three months ending at the end of April to consensus projections, $26 billion was made. The massive year-over-year growth was comparable to the previous quarter’s 265 per cent surge. Nvidia anticipates revenue for the current quarter of roughly $28 billion, give or take 2%, as opposed to average projections of $26.8 billion.

High demand for Nvidia’s current generation Hopper GPUs drove up the company’s data centre revenue, which is related to its coveted AI chips, to $22.6 billion for the quarter, according to Nvidia Chief Financial Officer Colette Kress, who addressed investors. It is anticipated that shipping of the Blackwell chip will begin this quarter.

The value of Nvidia shares has more than doubled during this year’s explosive surge, as they were up 8.3% in early trading on Thursday. In addition, the chipmaker declared that it was increasing its quarterly cash dividend by 150% and that it was implementing a 10-for-1 stock split starting on June 7.

Trader expectations for Nvidia shares and the markets as a whole were high ahead of the result announcement. Due to its tremendous rise, the stock is now one of Wall Street’s most-watched names. Its market capitalization has more than sixfold climbed to $2.3 trillion since the beginning of 2023, surpassing both Amazon and Google parent Alphabet to rank as the third most valuable US-listed corporation.

Nvidia has been moving swiftly to take advantage of the spike in demand for AI and maintain an advantage over rivals and clients who are creating their own AI chips. It unveiled the Blackwell chips in March, claiming that they are five times more effective at “inference”—the rate at which these models can react to inquiries—and twice as potent as the chips of the current generation for training AI models. That was only a year after the business unveiled Hopper, the GPU chip architecture from the previous generation.

Experts had speculated that as a transient “air pocket” in demand emerges, Nvidia’s significant year-over-year increase may be impacted by the switch to a new product line. Because of its fast chip releases, Amazon has shifted its plans to order chips based on the Blackwell line instead of the latest generation of Nvidia’s architecture.

However, Huang gave investors comfort, saying that demand was “way ahead of supply” for both the Hopper and Blackwell lines and that this would likely continue “well into next year.” At $5.98, diluted earnings per share were risen almost 600% from the previous year. Analysts had forecast a gross margin of 77.4%, but the actual number was slightly higher at 78.4%. Net income was $14.9 billion, which exceeded the projected amount of $13.2 billion.

Competitors rival Nvidia’s AI data center processors, AMD and Intel have been collaborating with Nvidia’s customers to provide substitutes for its Cuda software platform, further solidifying Nvidia’s position as a leading chip supplier.

It appears that Intel and AMD have not yet benefited from the surge in demand, as evidenced by their unimpressive first-quarter results and cautious outlook released in April. Microsoft revealed on Tuesday that it will be running some of the most demanding AI workloads on its Azure cloud service with AMD’s new MI300X accelerator processors and its ROCm software.

Daniel Newman, CEO of The Futurum Group, stated, “Nvidia beat on the data centre [revenue] and beat across the board.” “This number was anticipated by the entire market, and Nvidia delivered.” He went on to say that the stock split would result in “more accessibility” and “additional momentum for the stock.” “The trade in AI is thriving.”

Discover more from TechBooky

Subscribe to get the latest posts sent to your email.